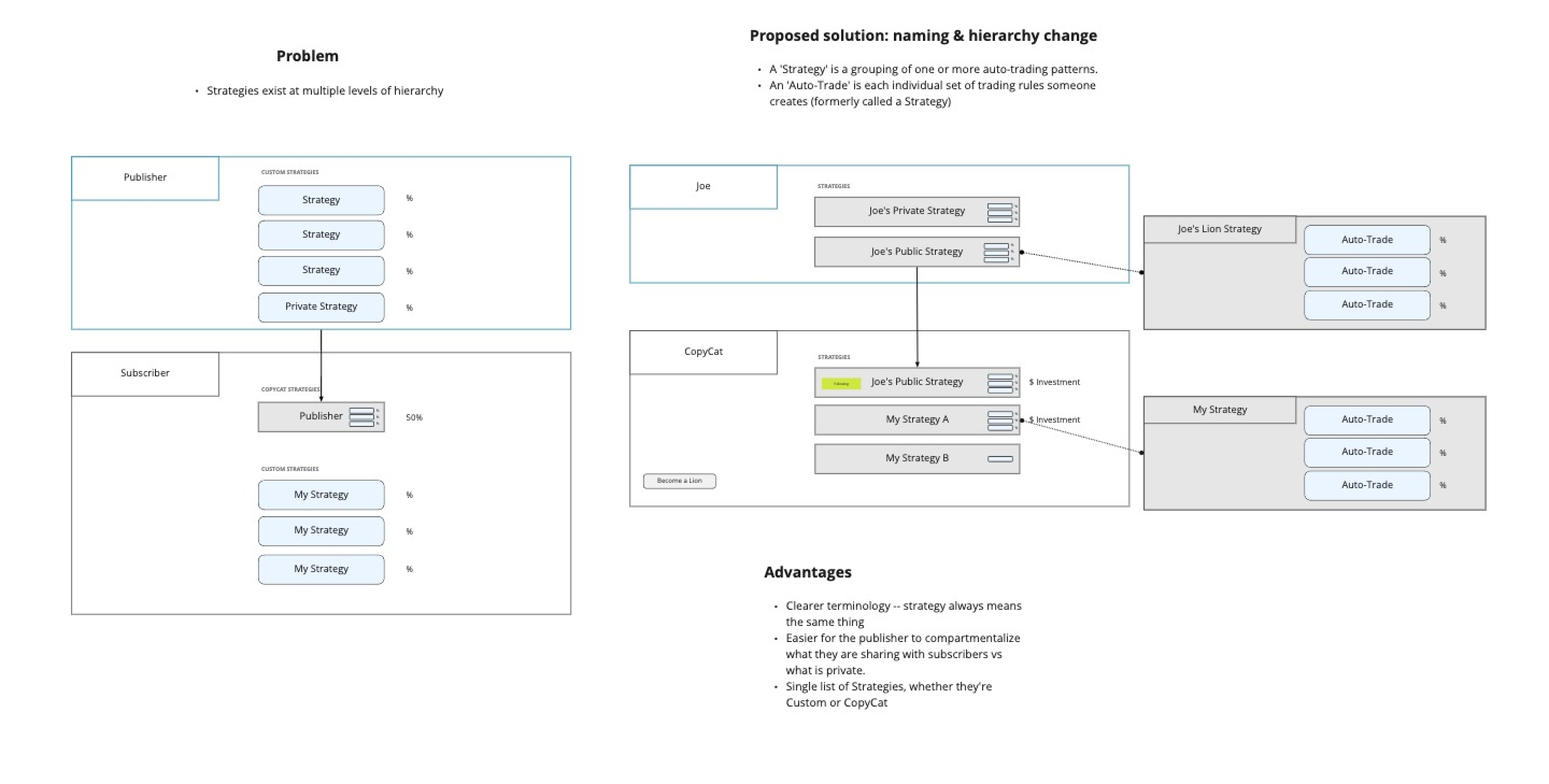

Crypto was new to me, so I took a deep dive into terminology and competitor products. Meanwhile, I also started diagramming some discrepancies between my mental model of how I expected an investment product to work, vs how CoinLion’s backend was set up.

The difference between reinvested growth and rebalanced growth turned out to be key. In order to compare the relative success of different strategies, a user should be able to choose to reinvest profits in the same strategy that generated them. However, CoinLion’s back-end was only set up to rebalance into a single pool of funds per account.

Without time for formal research, I asked colleagues and friends which behavior they would expect from an investment product. Overwhelmingly, they chose reinvestment. It turned out, even CoinLion’s executives agreed.